Why financial literacy matters

Financial literacy is more than just knowing how to count money—it's about understanding how to manage it, make informed decisions, and avoid common financial pitfalls. Poor money management can lead to a range of issues, including high debt, bad credit, and financial instability, all of which can have lasting consequences. Unlike forgetting algebraic equations, which may not affect your daily life, making poor financial choices can determine whether you can afford to pay bills or buy a home.

Basic financial skills like budgeting, understanding credit, and knowing how interest works are fundamental for long-term success. Teaching children these concepts helps them build a foundation for making smart financial decisions as they grow into adulthood. For instance, learning how to avoid bad debt, save money effectively, and use tax-advantaged accounts will allow them to better navigate the complexities of financial management in their 20s and 30s.

Financial literacy in schools

While financial literacy is included in many high school curriculums, it is often insufficient. The Financial Consumer Agency reports that despite the presence of such programs, limited resources and competing priorities mean many schools do not dive deeply into the topic. This leaves a significant gap in education, meaning many students enter adulthood without the necessary skills to handle their finances effectively.

Fortunately, the focus on financial literacy is gradually shifting. Schools and governments are beginning to acknowledge the importance of providing young people with the knowledge they need to make informed financial decisions. However, even with these changes, parents play a crucial role in supplementing their children’s education with practical financial lessons at home.

Financial lessons to teach your kids

Financial literacy should begin at home, long before children encounter it in a classroom. By introducing simple concepts early, you can build a strong foundation that will prepare them for more advanced financial topics as they grow.

Young kids (ages 3 to 7)

For young children, financial lessons should focus on the basics. Introduce the concept of money through simple, playful activities like counting coins or playing pretend store. A toy cash register with paper money is an excellent tool for helping children understand the value of money and how to use it.

One of the first financial habits to instill is saving. Giving children a piggy bank encourages them to save regularly, helping them learn patience and goal setting. You can make it a rewarding experience by allowing them to save for small, desired items, showing them the value of waiting and working toward a goal.

School-age kids (ages 8 to 12)

As children grow, it’s essential to begin connecting money to work. Introduce the concept of earning money through chores or small tasks around the house. By receiving an allowance tied to effort, children start to understand that money comes from work, not just from parents.

This age is perfect for introducing basic budgeting. Help your child set financial goals for desired purchases, track their spending, and divide money into categories like saving, spending, and giving. Budgeting can be as simple as allocating pocket money or allowance into these categories to show the importance of managing money responsibly.

Teenagers (ages 12 to 18)

Teenagers are ready for more advanced financial concepts. Start by discussing banking fundamentals, such as how to open and manage a bank account. Teach them about interest rates, loans, and the basics of investing. As they grow older, encourage them to take on part-time or summer jobs, which will give them practical experience in managing their earnings.

It’s also a great time to teach them about credit, how credit cards work, and the dangers of falling into debt. Showing them how compounding interest works—either in their favor (through savings) or against them (through debt)—is an important lesson. Tools like the Bank of Canada’s compound interest calculator can help visualize the effects of small, consistent investments over time.

Lead by example: modeling good financial habits

Children learn not just by what they are told but by what they observe. If you want to raise financially literate children, it’s crucial to model good financial behavior yourself. Regularly talk about money with your kids. Explain your financial decisions, whether it's budgeting for a family vacation, saving for a big purchase, or managing monthly expenses.

When making significant financial decisions, such as buying a home or a car, involve your children. Bring them along to the bank or discuss the decisions at the dinner table. Encourage them to ask questions, and explain financial terms in simple, understandable language. This demystifies money management and helps them feel more confident about handling finances as they grow.

source: CTV News

Are you thinking about investing in real estate in Albania? Looking for a safe and profitable opportunity? Balfin Real Estate

Are you thinking about investing in real estate in Albania? Looking for a safe and profitable opportunity? Balfin Real Estate The issue of tariffs has gained significant attention in Canada following months of warnings from U.S. President Donald Trump. Tariffs

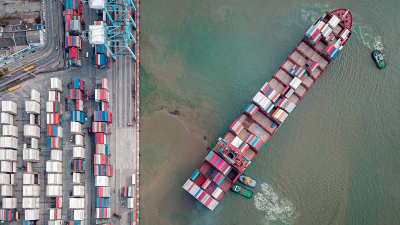

The issue of tariffs has gained significant attention in Canada following months of warnings from U.S. President Donald Trump. Tariffs The Canadian government has taken decisive action following new U.S. tariffs. Prime Minister Justin Trudeau announced immediate countermeasures after President

The Canadian government has taken decisive action following new U.S. tariffs. Prime Minister Justin Trudeau announced immediate countermeasures after President