Table of contents:

- What is a tariff?

- Why do governments impose tariffs?

- How will tariffs affect consumers?

- How will tariffs impact the Canadian economy?

What is a tariff?

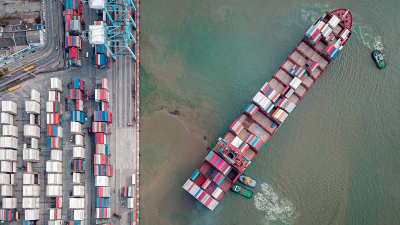

A tariff is a tax applied to imported or exported goods. Importers pay tariffs when bringing products into a country, which can raise the final cost of those goods.

For example:

- If the U.S. imposes tariffs on Canadian goods, Canadian exporters will face higher costs to sell products in the U.S.

- If Canada retaliates with tariffs on U.S. imports, Canadian businesses will pay additional fees when bringing in American goods.

As a result, tariffs often lead to higher prices for consumers.

Why do governments impose tariffs?

According to Export Development Canada, governments use tariffs for three main reasons:

- Revenue generation – Tariffs act as a source of government income, similar to sales taxes.

- Protecting domestic industries – Higher tariffs on foreign products can encourage consumers to buy locally produced goods.

- Diplomatic leverage – Tariffs can be used as a political tool to influence trade policies and international relations.

Governments sometimes introduce tariffs to respond to economic or political

Are you thinking about investing in real estate in Albania? Looking for a safe and profitable opportunity? Balfin Real Estate

Are you thinking about investing in real estate in Albania? Looking for a safe and profitable opportunity? Balfin Real Estate The issue of tariffs has gained significant attention in Canada following months of warnings from U.S. President Donald Trump. Tariffs

The issue of tariffs has gained significant attention in Canada following months of warnings from U.S. President Donald Trump. Tariffs The Canadian government has taken decisive action following new U.S. tariffs. Prime Minister Justin Trudeau announced immediate countermeasures after President

The Canadian government has taken decisive action following new U.S. tariffs. Prime Minister Justin Trudeau announced immediate countermeasures after President