Changing demographics and financial realities

Historically, senior discounts were introduced in the 1960s, a time when many older adults were financially vulnerable. Harry Kitchen, a professor emeritus of economics at Trent University, explains that retired individuals often had little to no pension income, making them a primary target for financial assistance through discounts. This practice aimed to ease their economic burden as they transitioned out of the workforce.

However, the financial landscape has shifted considerably since then. According to Statistics Canada, only 6% of Canadians aged 65 and older are classified as low-income, compared to 11.1% of all other adults. This data, drawn from 2022, highlights a significant change in the economic well-being of seniors. While poverty among single seniors, particularly women, is higher at about 14%, it is still substantially lower than the 31% poverty rate among single individuals in other age groups.

The argument for and against senior discounts

The persistent use of senior discounts despite improved financial conditions among many older adults raises questions about their current necessity. Laura Backstrom, a cellist and teacher in Victoria, points out the disparity in financial relief between seniors and younger adults. She notes that while seniors enjoy discounted rates for recreational activities, young families struggle with high costs of living, including exorbitant childcare and mortgage expenses. For instance, a senior might pay $95 for a three-month pass at a recreation center, while an adult pays $120—a significant difference considering the financial pressures on young families.

Lisa Evans, a single parent from Dundas, Ontario, echoes this sentiment. She acknowledges that some seniors are in better financial positions than younger people, who face stagnant wages and skyrocketing housing costs. Evans suggests that discounts could be more beneficial if extended to parents or younger individuals who are disproportionately affected by the current economic climate.

Historical context of senior discounts

The introduction of senior discounts coincided with the establishment of key social safety nets in Canada, such as the Canada Pension Plan (CPP) and Guaranteed Income Supplement (GIS) in 1967. These measures were crucial in reducing poverty among seniors at the time. Kitchen notes that the proportion of poor people over 65 is now smaller than in any other age group, a testament to the effectiveness of these programs.

Despite these improvements, some argue that measures of poverty like the market basket measure (MBM) do not adequately account for seniors' specific needs, such as health-related expenses. Diane Bracuk from Toronto highlights how discounts at places like Shoppers Drug Mart help cover costly medical supplies and medications, which are essential for maintaining their quality of life.

The impact of removing senior discounts

Eliminating senior discounts could have significant repercussions for businesses and the seniors who rely on them. Steven Shechter, a professor at the Sauder School of Business at the University of British Columbia, warns that businesses might face backlash from powerful seniors' advocacy groups if they remove these discounts. Retail consultant Doug Stephens adds that today's seniors are generally in a better economic position than their predecessors, yet the discounts persist.

Shane Coutinho, a 34-year-old public service employee living with his parents to save for a home, offers a perspective on the younger generation's struggles. He acknowledges the benefits seniors receive but suggests that extending similar discounts to younger adults could help them manage their financial burdens more effectively.

As the economic conditions and financial needs of different age groups continue to evolve, it's crucial to reassess the justification for senior discounts. While these discounts were vital in the past, the improved financial status of many seniors and the increased economic pressures on younger generations suggest a need for a more balanced approach. Expanding discounts to include young adults and parents could provide much-needed relief and promote greater economic equity.

source: CBC

Are you thinking about investing in real estate in Albania? Looking for a safe and profitable opportunity? Balfin Real Estate

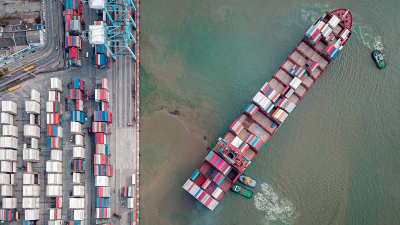

Are you thinking about investing in real estate in Albania? Looking for a safe and profitable opportunity? Balfin Real Estate The issue of tariffs has gained significant attention in Canada following months of warnings from U.S. President Donald Trump. Tariffs

The issue of tariffs has gained significant attention in Canada following months of warnings from U.S. President Donald Trump. Tariffs The Canadian government has taken decisive action following new U.S. tariffs. Prime Minister Justin Trudeau announced immediate countermeasures after President

The Canadian government has taken decisive action following new U.S. tariffs. Prime Minister Justin Trudeau announced immediate countermeasures after President