Tariffs and their influence on inflation

Trump’s plan to impose a 10 per cent tariff on imports could have major consequences. Economists from Goldman Sachs estimate these tariffs might push U.S. inflation to nearly three per cent by mid-2026. Sheila Block, a Canadian economist, warns that higher tariffs typically increase prices for consumers.

Higher inflation may slow the pace of interest rate cuts by the Federal Reserve, disrupting current market expectations.

Changes in U.S. interest rate strategy

The Federal Reserve recently lowered its interest rate to the 4.5 to 4.75 per cent range. However, inflationary pressures from Trump’s policies could delay further cuts. According to TD Economics, the Fed may hold its rate at 3.5 per cent by the end of 2025, rather than the previously forecasted three per cent.

Markets are adjusting their expectations, predicting the Fed will maintain higher rates for longer than anticipated.

Canadian economy and import challenges

Trump’s proposed tariffs may indirectly impact Canada’s economy. A weaker Canadian dollar relative to the U.S. dollar could raise import costs, adding temporary inflationary pressure. Sheila Block emphasizes that Canadian monetary policy will likely reflect these challenges.

The Bank of Canada is expected to lower interest rates faster than the Federal Reserve due to weaker economic conditions.

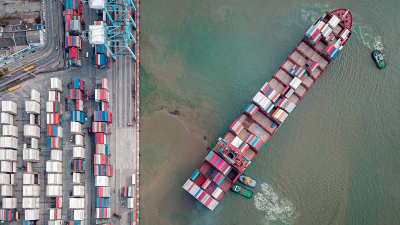

Trade implications for U.S. and Canada

U.S. tariffs could significantly affect trade with Canada. TD economists project that Canadian exports to the U.S. may decline by nearly five per cent by early 2027. Higher production costs and tariffs could further hinder trade dynamics.

This could push the Canadian dollar below 70 cents U.S., widening economic gaps between the two countries.

Trump’s economic proposals are likely to reshape financial strategies in both the U.S. and Canada. Inflationary trends, altered interest rate policies, and trade adjustments will define the economic landscape in the coming years. Careful monitoring and strategic planning will be essential for both nations to navigate these shifts.

source: CTV News

Are you thinking about investing in real estate in Albania? Looking for a safe and profitable opportunity? Balfin Real Estate

Are you thinking about investing in real estate in Albania? Looking for a safe and profitable opportunity? Balfin Real Estate The issue of tariffs has gained significant attention in Canada following months of warnings from U.S. President Donald Trump. Tariffs

The issue of tariffs has gained significant attention in Canada following months of warnings from U.S. President Donald Trump. Tariffs The Canadian government has taken decisive action following new U.S. tariffs. Prime Minister Justin Trudeau announced immediate countermeasures after President

The Canadian government has taken decisive action following new U.S. tariffs. Prime Minister Justin Trudeau announced immediate countermeasures after President